Enabling frictionless information flow in Commercial Insurance

Commercial Insurance industry is desperate to find efficiencies, but not at the expense of the tailored risk exchange valued by its clients. An opportunity exists to transform the exchange of information and retain competitive structures and systems without compromising on client service.

“By leveraging Insurants, MMC has automated manual processes, centralized operations, and gained valuable insights. This partnership has enabled us to achieve unparalleled efficiency, cost savings, and superior data quality.”

Paul Beswick, MMC CIO

What we do

Insurants revolutionizes the commercial insurance industry by eliminating friction in the process while maintaining the ability to offer personalized risk exchange and client service. In collaboration with Marsh McLennan, Insurants leverages a portfolio of over 1,000 algorithms to intelligently extract and process data from a vast array of commercial insurance documents, including policies, quotes, binders, and financial statements.

An eight fold increase

in speed of processing

Elevate Data Extraction

Accuracy to New Heights

Liberate Time for High Impact

Workand Retain Top Talent

Master Complex Data Handling

GenAI Infused

of policy, binders, slip documents

How we do it

Insurants uses advanced AI and GenAI technologies to intelligently automate the extraction and processing of data from complex commercial insurance documents. With a library of over 1,000 algorithms, Insurants understands the nuances of the insurance industry, enabling efficient handling of various formats and layouts. This allows us to seamlessly integrate with existing systems, supporting brokers, carriers, and MGAs by enhancing operational processes without the need for disruptive transformations. Our solution accelerates workflows, improves policy governance, and delivers customized support across the insurance value chain.

International Recognition

We were excited to be selected for the UK Insurtech Global Business Innovation programme, the UK’s national innovation agency. It was a testament to the great work and collaboration with our clients. Through the programme, we strengthened connections and deepened our understanding of local markets.

Award Winning

Delighted to have been invited to present at Hartford Insurance Week and honored to win two awards, being recognized for ‘Best Problem Solution Fit’ and ‘Most Innovative Solution’.

Insurants Solving Challenges in Commercial Insurance

Policy Indexing

Large broking firms need to process hundreds of thousands of complex commercial policy documents and endorsements hundreds of pages long every year. Using a variety of data hunting techniques, data validation, and business logic Insurants can deliver highly accurate results consistently over a wide range of document variants.

Commercial Insurance Slips

Brokers face a challenge in extracting information accurately and at scale from scores of data points in property and FinPro documents. Automating using Insurants, We achieves highly accurate results by applying data extraction and business rules to unstructured, and often low-quality, inputs from multiple markets.

Policy Comparison

Policy comparison for major global brokers can easily encompass upwards of 50,000 document variations from 450+ carriers over 70+ coverages. Insurants can extract and compare scores of data points and carry out multiple checks on 100s of data items. Insurants can handle all these through pattern recognition and without templating.

Marsh drives operational efficiencies and access to critical data through deployment of Intelligent Document Processing (IDP) technology.

About Marsh:

With offices in more than 130 countries, Marsh is the world’s leading insurance broker and risk advisor. Marsh provides industry-focused brokerage, consulting, and claims advocacy services, leveraging data, technology, and analytics to help reduce their clients’ total cost of risk.

The Challenge:

Marsh policy servicing and operations teams manually extract data from thousands of complex policies, slips, proposal forms, financial statements and subsequently, again manually, update core systems. Processes are time consuming, complex, error prone and not scalable, they are costly and present data quality issues.

The complexity challenge is exacerbated by the unstructured nature of the documents received in their 10’s of thousands from 475+ different carrier subsidiaries, 50+ coverages and 150+ data fields.

The Solution:

AntWorks and Marsh have worked since 2020 to innovate together and deploy Insurants configured for Marsh’s specific global needs, leveraging the rich data hunting techniques of CMR+ to extract even the most complex data points, Marsh has been able to automate manual processes, centralise operations into lower cost geographies, create its own Centre of Excellence and gain access to mission critical data.

Continuous improvement

in accuracy achieved by

assisted and machine learning

An eight fold increase

in speed of processing

Empower Strategic

Decision-Making

Notable cost reduction

Automated accuracy of more

than 90% with the gap to

100% closed by staff

Staff redeployed into

value adding activity

The Science Behind Insurants

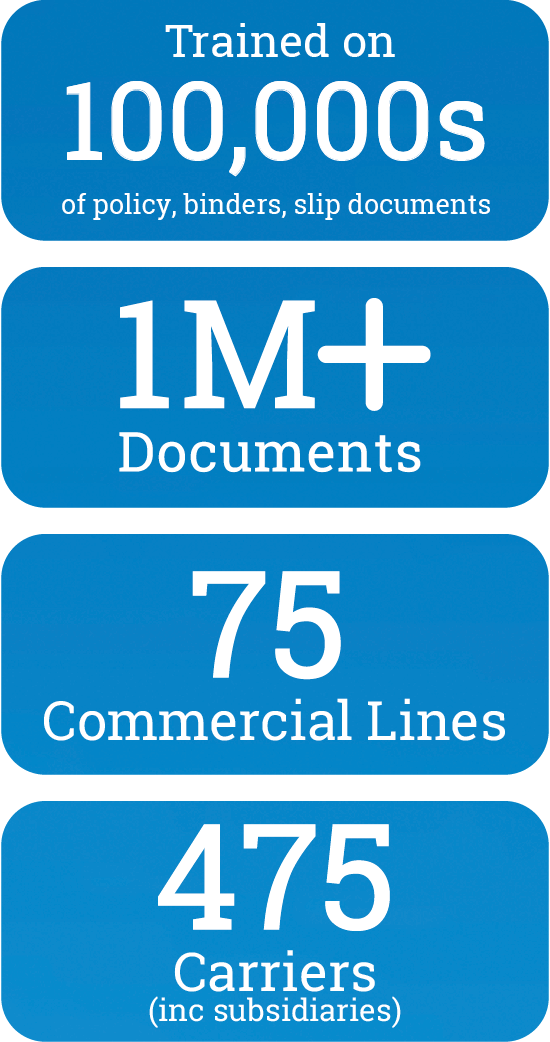

AntWorks, a market leading intelligent document processing platform, has been working with Marsh for 5 years to address the specific needs of the commercial insurance industry. ‘Insurants’ is the culmination of that work. It’s been trained on 100,000s of policies, binders, quotes, endorsements, slips, loss runs, SOVs to extract and abstract data in support of commercial insurance processes. In production Insurants processes millions of pages a year delivering unrivalled accuracy, adoption and straight through processing as appropriate.

The scale and breadth of Marsh and their appetite to serve their clients, carriers and partners set a high bar and a requirement to support 75 commercial lines, 475 carriers (inc subsidiaries) in multiple languages.

From the Simple to the Complex

Insurants deep understanding of the commercial insurance industry, processes and language accelerated creation of more than 1000 algorithms. These algorithms are organised and packaged to be used individually or in combination to capture, classify, index, extract, organise and export information held in unstructured, semi-structured and structured formats.

The simplest extractions use commonly available techniques and technologies like Optical Character Recognition and Natural Language Processing, the more complex demand Machine Learning, Artificial Intelligence and Generative AI. The most complex require a combination.

GenAI uniquely delivers additional use cases, Abstractions. The ability to find and compare meaning, to interpret and inform decision making.

This patent pending combination of technologies and treatments dedicated to the commercial insurance industry delivers unrivalled breadth and ability to orchestrate information extraction and abstraction across all commercial insurance lines and processes.

Insurants’ Ben Platts on the benefits of document ingestion

The pair discussed why the benefits of document ingestion might not have been fully realised yet, despite being on the radar of insurance companies for years, and Platts offered insights into the firm’s work with global broker Marsh. He also outlined what solutions Insurants could offer the market, and what it had planned in 2024 and beyond.

Factors to consider when adopting Insurants

Automating document processing in commercial insurance is not without challenges, particularly in areas such as data privacy and security, the need for extensive data to develop training models, and the handling of complex or poor-quality documents. However, Insurants has been built to address many of the challenges including data privacy, regulatory compliance and accuracy.

Privacy

Insurance documents often contain sensitive personal and financial information. Ensuring the security of this data during automated processing is paramount. Moreover, the insurance sector is subject to strict data protection laws, such as GDPR in Europe, and various privacy laws in other parts of the world. Automation must be designed from scratch with these requirements in mind.

Regulatory Compliance

Training AI and ML models requires extensive data, which must be collected in compliance with privacy laws. Insurants is pre-trained to offer rapid implementation and outcomes. Developed based on practical, regulated work at Marsh over four years, Insurants handles a variety of documents within regulatory frameworks. Additionally, Insurants provides an audit trail for oversight of its work.

Accuracy

Ensuring accuracy in automated systems, especially in complex documents, is challenging. Insurants tackles this with features like matching references, names, and clauses. Its pre-processing, data extraction, enrichment, confidence scores, and quality checks ensure reliable information. The system improves over time, learning from human-handled exceptions.

Contextual Understanding

Insurance documents are rife with industry-specific jargon and legal clauses. Insurants is trained specifically for insurance work. It is adept at navigating the sector’s complexities and nuances, and is designed to meet the unique challenges of the insurance sector, enhancing efficiency and accuracy in document processing.

Adoption

It is important to assess your requirements in terms of the number of pages of documents that you need to process and the complexity of the documents being reviewed. Policy intake and indexing is more straightforward than Policy Reviews or analysing a Loss Run. The assessment should consider the complexity of your requirements including types and structures of the documents.

Data Quality

Another challenge to automating insurance document processing is the poor quality of the captured content due to scanning issues, handwritten notes, or old formats, making automated processing difficult. Using its advance IDP capabilities, Insurants can pre-process information to tackle these issues, including digesting information from handwritten notes and removing noise and fuzziness from poor quality scanned documents.

Resources

AI-Powered Intelligent Document Processing: Reshaping the Commercial Insurance Industry

Introduction The rapid evolution in Artificial Intelligence (AI), especially in handling unstructured content, is poised to reshape the commercial insurance

Taming the Paper Juggernaut: Managing Document Complexity in Commercial Insurance

Every day Brokers and Carriers produce, read, interpret, and process a complex myriad of documentation including policy documents loss run

I can’t wait for Blueprint 2…

With the Insurer and Insurance Insider reporting on 22nd March of another delay to Blueprint 2 (Phase 1 moving to

Scaling up new technology while avoiding the pitfalls

A recent Insurance Post roundtable held in association with Insurants explored the complexity issue. Valerie Hart reports.

Drowning in documents: how to make working in insurance more rewarding

Across the commercial insurance market, lots of time is spent on core processes, such as searching for information across emails

Bringing Insurants to the US with support from Innovate UK

This April, we embarked on an inspiring journey to the United States, filled with strategic meetings and invaluable networking opportunities.

Amplifying Commercial Insurance Productivity Tenfold via Generative AI and IDP

Insurance companies need to keep pace and adopt emerging technologies to innovate, staying behind the curve is not an option.

Insurants’ Ben Platts on the benefits of document ingestion

The pair discussed why the benefits of document ingestion might not have been fully realised yet, despite being on the

Why Commercial Insurance Companies are Drowning in Documents

Paperwork – it is a term that sends shivers down the spine of many professionals, particularly those working in the

Extraction of entities from unstructured Commercial Insurance Documents- leveraging NER and GenAI algorithms

You might be aware that in the vast sea of insurance documents, approximately 80% of valuable information is hidden within

The toothpaste is out of the tube

To support the risk exchange throughout the commercial insurance value chain standards, processes, templates, formats, layouts have emerged, in multiple

Insurants Joins AdGo Ecosystem, Bringing Proven AI Engine to Transform Data Submissions into Underwriting Workbench

AdvantageGo, the leading global commercial insurance and reinsurance software provider, part of Coforge, today announces an Ecosystem Alliance with Insurants, a

Insurants – Enabling Frictionless Information Exchange in Commercial Insurance

Unlock the potential of seamless information exchange in the Commercial Insurance industry with our latest eBook: “Enabling Frictionless Information Exchange

AntWorks Files Two Patents for AI-Powered Document Processing, Showcasing Innovation and Commitment to Customer Success

We’ve just filed two patents with the USPTO, pushing the limits of AI-powered document processing and automation. These innovations will

Insurants on the InsTech Podcast

Matthew spoke with CEO, Mike Hobday at Insurants, about document processing and bridging the language barrier between data that flows

Contact Insurants by filling out this form.

A member of our team will get back to you as possible.